net investment income tax 2021 form

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. Note that these amounts are not indexed for inflation.

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

See how much NIIT you owe by completing Form 8960.

. June 5 2021 340 PM There is a TT oversight regarding form 8960. How is the NIIT Reported. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT.

Taxpayers use this form to figure the amount of their net investment income tax NIIT. Commonwealth residents will file either Form 1040-SS or Form 1040-PR. Do not include sales tax or any foreign income taxes paid for which you took a credit.

You can download or print current or past-year PDFs of Form 8960 directly from TaxFormFinder. This form is to be included with the Form 1040 and Form 1041. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT.

The tax only applies if you report net investment income. Specifically taxpayers with adjusted gross income of more than 200000 single filers or 250000 joint filers are subject to the surtax on investment income that exceeds the thresholds. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or modified adjusted gross income.

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The statutory authority for the tax is. If a second couple also had 300000 of MAGI but 80000 was Net Investment Income their tax would be 1900 50000 X 38.

Most US resident taxpayers will file Form 1040 for tax year 2021. Married filing jointly 250000. Your IRS Form 1040 can help you calculate your net investment income tax.

According to an april 28 2021 congressional research service report the joint committee on taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-incomehouseholds see congressional research service the 38 net investment income tax. Your wages and self-employment earnings by themselves have no impact on the NIIT. Income Tax Return for Estates and Trusts Schedule G Line 4.

Nonresident taxpayers will file Form 1040-NR. Our guide covers the current rates thresholds and other rules. Net Investment Income Tax Line 9b Form 8960 The total of the state local and foreign income taxes that you paid for the current tax year is entered on line 9b of form 8960.

Tax Treaty with France did not change the general rule that the foreign tax credit cannot offset the NIIT. The statutory threshold amounts are. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage.

4 2021 the court held that the US. The net investment income tax is reported on Form 8960. TT does not reduce your investment income by state and local taxes when calculating the investment surcharge.

The Net Investment Income Tax. This form allows you to make a separate investment income in the calculation of the investment interest limitation. First calculate your MAGI.

Start with your adjusted gross income see line 11 of your Form 1040. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. Your additional tax would be 1140 038 x 30000.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. You can print other Federal tax forms here.

The NIIT is set at 38 and that rate is relevant for both the 2020 and 2021 tax seasons. Seniors age 65 and older have the option to file Form 1040-SR this year which is basically the same as Form 1040. Apr 15 2021.

EFile your Federal tax return now. A the undistributed net investment income or B the excess if any of. Youll owe the 38 tax.

For example if a couple filing a joint return has a MAGI of 300000 and Net Investment Income of 30000 they exceed the threshold by 50000 and the 30000 is subject to 1140 of tax 30000 X 38. Current Revision Form 8960 PDF Instructions for Form 8960 Print Version PDF Recent Developments Taxpayer Relief for Certain Tax-Related Deadlines Due To Coronavirus Pandemic -- 14-APR-2020 Other Items You May Find Useful All Form 8960 Revisions. Net Investment Income Tax basics The NIIT only applies to certain high-income taxpayers.

Include in their investment income as much of their net capital gain investment income as they choose if they also reduce the amount of net capital gain eligible for the special federal capital gain tax rate. Enter only the tax amount that is attributed to the net investment income. April 28 2021 The 38 Net Investment Income Tax.

The net investment income tax applies to taxpayers who have a significant amount of investment income typically high-net-worth families and individuals with considerable assets. To give some background the net investment income tax is part of the Health Care and Education. Generally net investment income includes gross income from interest dividends annuities and royalties.

We last updated the Net Investment Income Tax - Individual Estates and Trusts in January 2022 so this is the latest version of Form 8960 fully updated for tax year 2021. A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. You can do it manually and in certain situations it will reduce the surtax you owe.

The net investment income tax NIIT is a surtax on high amounts of investment income. Second add back certain deductions including. The estates or trusts portion of net investment income tax is calculated on Form 8960 Net Investment Income TaxIndividuals Estates and Trusts and is reported on Form 1041 US.

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help Income Tax Income Tax

2021 2022 Income Tax Calculator Canada Wowa Ca

Minimalist Excel Template For Rental Property Buying Etsy In 2022 Excel Templates Templates Rental

Tfsa Guide 2021 Investing Financial Advice Tax Free Savings

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips

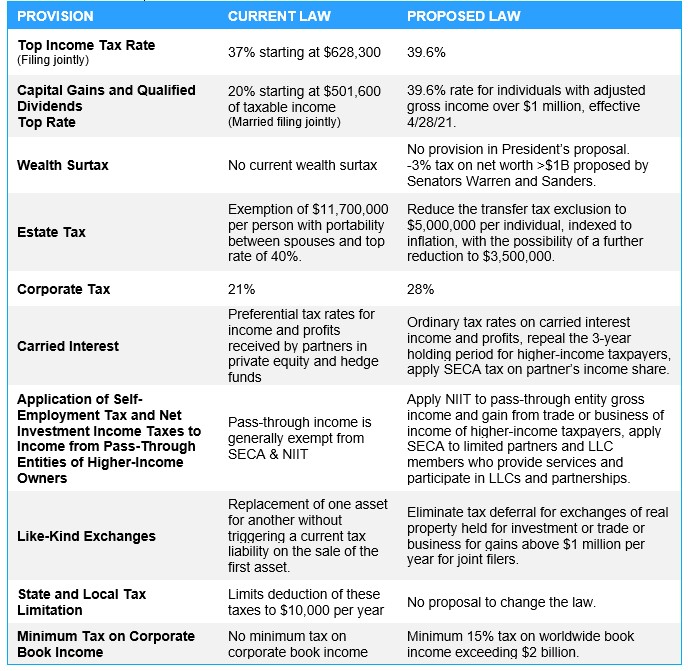

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

What Is The The Net Investment Income Tax Niit Forbes Advisor

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

03x Table 08 Income Statement Cash Flow Statement Financial Ratio

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Income Tax Task Cards Activity Financial Literacy Math For Kids Filing Taxes

Important Changes In The Balance Sheet Balance Sheet Intangible Asset Deferred Tax

What Are The Terms Used In Share Market Experts And Amateurs Use These Terms Frequently To Explain Trading Strategi Share Market Income Tax Trading Strategies

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)